THOUGHT LEADERSHIP

Your Guide to CMS Regulatory Changes for Payers

Every year brings new CMS rules and regulations for payers, but some years are especially transformative. Payers now face a wave of changes as Centers for Medicare & Medicaid Services (CMS) normalizes post-pandemic operations and prepares for the future.

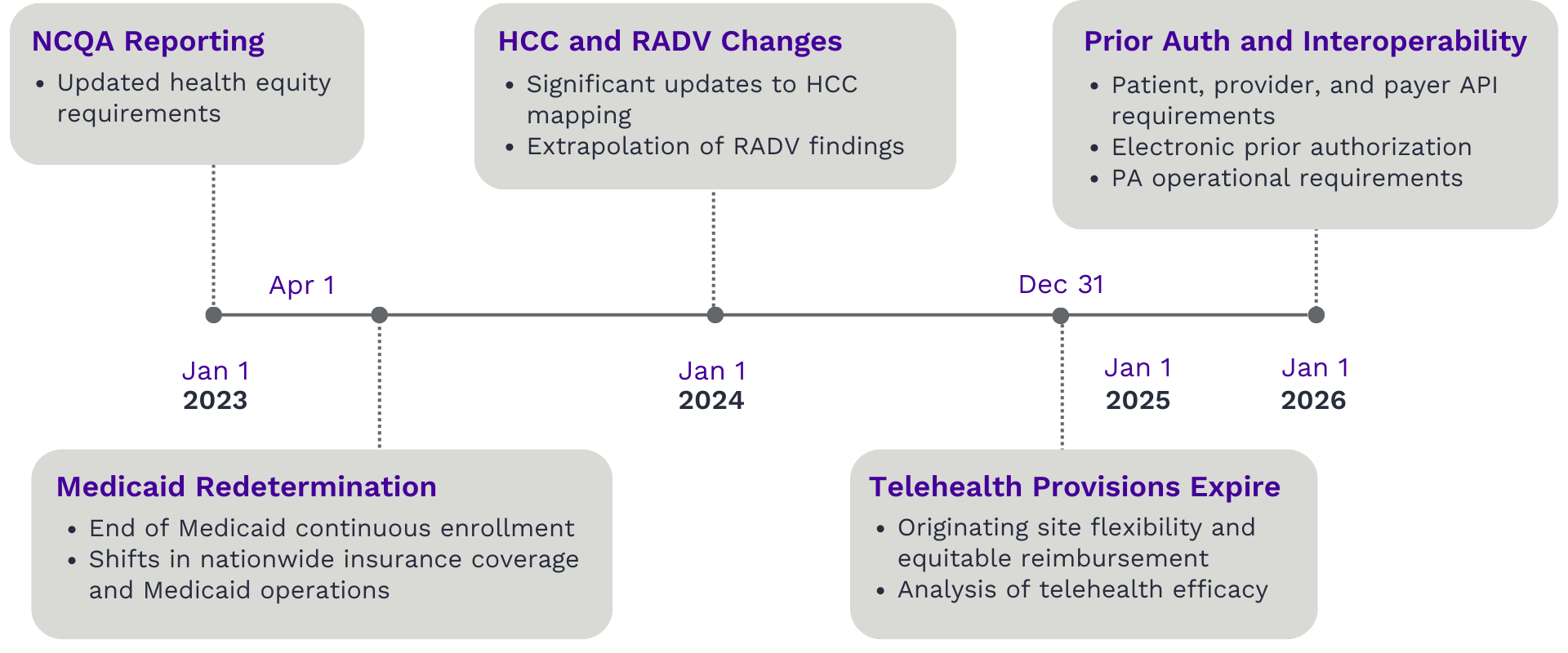

Newly announced and proposed CMS regulations aim to strengthen and modernize existing programs and address significant challenges facing healthcare, including provider burnout, cost control, and interoperability. These CMS regulatory changes began impacting payers in 2023:

- Changes to Hierarchical Condition Categories (HCCs)

- Medicare Advantage (MA) Risk Adjustment Data Validation (RADV) Final Rule

- CMS Advancing Interoperability and Improving Prior Authorization Processes Final Rule

New Regulatory Changes for Payers and Providers

Along with Medicaid redetermination beginning in 2023, these changes will trigger financial impacts over the next year and for years to come. Along with increased financial risks from CMS audits and shifts in policies affecting payments for certain conditions, payers face pressure to quickly adopt new coding models as they expand interoperability and strengthen payer provider integration.

Payers can succeed in this landscape, however. With strategic investments in healthcare payer technology, payers can use analytics to make data-driven decisions about how to best manage upcoming regulatory changes.

Medicare Advantage (MA) Risk Adjustment Data Validation (RADV) Final Rule

At a Glance

Earlier this year, CMS announced their plan for a new Risk Adjustment Data Validation (RADV) rule to recover overpayments (CMS-4185-F2) to health plans. Payment recoveries begin with payment year 2018 and are expected to total approximately $479 million per audit year.

Historically, CMS performs RADV audits by evaluating a small portion of records, and Medicare Advantage Organizations (MAOs) were required to return overpayments only for the records audited. Under the new rule, audit findings will be applied across the entire plan. This expands the risk of overpayment recoupments and dramatically increases financial impacts for MAOs.

What can payers do to prepare for 2024 changes?

Quantify the impact for your population and business model

Incorporate the impact into strategic planning

Evaluate internal processes and gaps

Leverage third-party expertise

Invest in collaborative payer-provider relationships

Changes to Hierarchical Condition Categories (HCCs)

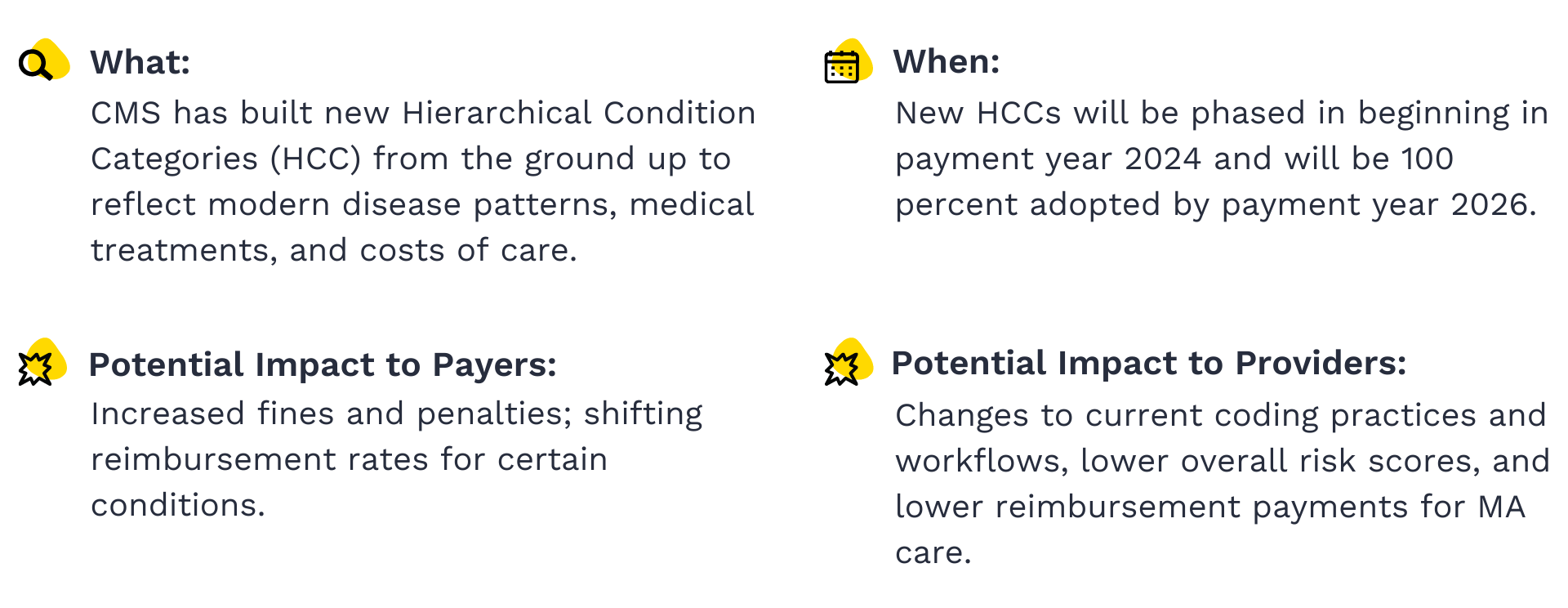

At a Glance Each year, CMS reviews and updates related categories of diagnoses, called Hierarchical Condition Categories, or HCCs, to better predict healthcare costs based on current medical treatments and disease patterns. For 2024, CMS announced a significant reclassification of HCCs that involved building new condition categories based on input from clinical experts.

Each year, CMS reviews and updates related categories of diagnoses, called Hierarchical Condition Categories, or HCCs, to better predict healthcare costs based on current medical treatments and disease patterns. For 2024, CMS announced a significant reclassification of HCCs that involved building new condition categories based on input from clinical experts.

Prior to this change, HCC codes were built using outdated ICD-9 diagnosis codes, which required CMS to map newer ICD-10 codes submitted by health plans to its ICD-9 condition categories. Updating the underlying data for HCCs enables CMS to improve its predictive ability with clinically sound diagnosis codes.

This change could impact risk adjustment scores, resulting in lower payments for payers and providers. And the removal of thousands of ICD-10 codes and the addition of new codes may increase the risk of coding mistakes for payers and providers.

How are HCCs changing for 2024?

New categories and renumbered disease groupings

An additional 35 categories have been added to the payment model for 2024 for a total of 115 disease categories, encompassing over 7,000 mappable ICD-10 codes. The new model removes 2,000 ICD-10 codes payable in previous models.

Like previous models, a singular diagnosis code can map to multiple HCCs in the 2024 model. However, the 2024 model leverages the “one diagnosis code to multiple HCCs” relationship more frequently, meaning fewer codes will map to more condition categories.

HCC disease groupings have been renumbered, which may cause confusion as the renumbering of HCC disease groupings can be confusing as they do not seem to correlate to any previously assigned categories from version 24. Providers and coders will need to adjust current workflows and coding preferences to reflect the updated groupings.

Removal of previously mapped common ICD-10 codes associated with subsequent encounters and sequela

The 2024 model excludes most ICD-10 codes for subsequent encounters and sequela. Subsequent encounters describe routine care or maintenance of a stable condition. For example, when a patient with a broken arm has an emergency surgery for which they were treated by an emergency room physician and a surgeon, both are considered initial encounters because the patient has an active health condition that requires active intervention and is not yet stable.

When the same patient returns to the office as an outpatient eight weeks later for cast removal, the patient is now considered to be in recovery and the encounter is coded as a subsequent encounter. Sequelae are secondary conditions that arise as a result of another illness or injury.

Limitations placed on discretionary coding through constraining of HCC coefficients for specified disease groupings

The 2024 model also limits discretionary coding for complex disease states and groups certain diseases together for risk adjustment. CMS assigns coefficient values to each HCC category to represent the relative risk associated with the underlying diagnosis and ultimately help determine the appropriate payment. Constraining is a process in which CMS assigns similar ICD-10 codes in a particular disease grouping the same coefficient value used for risk adjustment. The process is supported by Principle 10 which clarifies that diagnoses that are particularly subject to the intentional or unintentional discretionary coding variation or inappropriate coding should be excluded from the payment model.

Discretionary coding occurs when a provider treating the patient uses a code indicating a more complex disease state with a higher coefficient than is supported by clinical documentation. An example of discretionary coding is when a provider codes a patient with controlled diabetes as complicated diabetes. This typically occurs when the provider utilizes the discretion of their clinical opinion regarding the disease state, or when a provider chooses to intentionally up-code to obtain higher reimbursement.

This change could impact both payers and providers as this decision could lower risk adjustment scores, resulting in a decrease in payment while still investing in a higher acuity of care. Consequently, providers in certain geographical areas or that treat a higher percentage of patients with certain impacted diagnoses may be disproportionately affected and experience a compounded effect as a result.

Payers need to understand the nuances of these new regulations to plan effectively as they prioritize strategic investments and strengthen valuable partnerships.

Navigating Financial Impacts

How can payers prepare for financial impacts from the RADV rule and HCC changes?

- Use analytics to quantify expected revenue impacts and inform data-driven financial decisions.

- Evaluate interoperability capabilities and make strategic investments as needed.

- Establish processes and workflows to completely and accurately capture relevant diagnoses on claims and supporting documentation to avoid potential overpayments and recoupments for current and future payment years.

- Ensure that these changes are reflected in risk adjustment workflows to prevent HCC coding errors starting in 2024.

- Look for ways to improve coding accuracy through automation, workflow improvements, and other initiatives.

- Strengthen payer-provider collaboration and identify provider partners who may benefit from training and resources to support efficient, accurate operations.

CMS Advancing Interoperability and Improving Prior Authorization Processes Final Rule

At a Glance

New interoperability and prior authorization requirements for Medicare Advantage, Medicaid, Qualified Health Plan (QHP), and Federally Facilitated Exchange (FFE) payers aim to make care more accessible and transparent. Impacted payers must implement aspects of the new requirements by Jan. 1, 2026, but generally have until 2027 to meet API development and enhancement requirements. Exact compliance dates vary by the type of payer.

Final rule CMS-0057-F requires payers to operate more efficiently and share information effectively with providers and other health plans. To meet these new requirements, payers should begin planning and building capabilities to address the rule’s four categories: health information exchange between payers, expansion of the 2020 Patient Access API, exchange of member information with in-network providers, and updates to prior authorization requirements.

Categories Payers Should Address To Meet New Requirements Under CMS-0057-F

Health information exchange between payers

Expansion of the 2020 Patient Access API

Exchange of member information with in-network providers through a Provider Access API

Updates to technical and operational prior authorization requirements

What Do Payers Need to Know About the Final Rule?

Exchange of member information between payers

The CMS Advancing Interoperability and Improving Prior Authorization Processes rule aims to ease care coordination for members with multiple coverages and enable the maintenance of a single longitudinal health record for each member when they transfer insurance carriers.

In addition to the requirement for payer-to-payer data exchange, introduced by CMS in the 2020 Interoperability and Patient Access rule, this final rule adds the exchange of prior authorization requests and decisions to the requirements.

Per the final rule, payers should be able to exchange data via API at the member’s request. If a member has concurrent coverage, impacted payers should ensure relevant data is made available at least quarterly to the concurrent payer(s).

The new requirements do not require payers to exchange any financial data.

Expansion of the 2020 Patient Access API

The final rule expands the Patient Access API to include prior authorization information. As part of the 2020 CMS Interoperability and Patient Access final rule, which built on the 21st Century Cures Act Final Rule, payers are required to provide a standard base API to allow patients to access their health information through third-party applications.

While the previous version of this rule focused on making claims, encounters, and specific clinical information to improve patient decision-making and care available to patients, the updated rule requires payers and providers to ensure that authorization information is available via API as well.

Exchange of member information with in-network providers

The final rule is intended to support progress toward value-based care contracting and facilitate care coordination. Payers are required to share claim, encounter, and prior authorization requests and decisions with in-network providers through a Provider Access API.

Updates to technical and operational requirements for prior authorization

The final rule outlines the API requirements for prior authorization exchange and operational changes to prior authorization review practices.

API Requirements:

- Payers need to support a Fast Healthcare Interoperability Resources® (FHIR®) Application Programming Interface (API) that enables the exchange of prior authorization information with a provider’s Practice Management System or Electronic Health Record (EHR).

- The data exchange needs to include:

- Whether prior authorization is required for the given member encounter.

- Prior authorization information and documentation requirements.

- Prior authorization requests and corresponding decisions.

- The current standard to exchange prior authorizations in the ANSI X12 278 version 5010 remains.

- Payers are required to share patient data dating back five years from the request.

Operational Requirements:

- Payers need to provide denial reasons where applicable with enough detail to facilitate the correction and resubmission of requests. This requirement is intended to improve communication between payers and providers and reduce the amount of administrative work required for denied and overturned authorization requests.

- Payers need to significantly increase the speed and efficiency of prior authorization review to meet the shortened requirements.

- Standard prior authorization turnaround times will decrease by half, shortening the maximum turnaround time from 14 calendar days to seven. CMS has left the door open to further shorten the time frame for both urgent and standard requests.

- Payers must allow patients to opt out of having their data available to providers and notify them of this option.

How should payers plan for success as prior authorization and interoperability requirements roll out?

Determine the best solution, or set of solutions, to meet CMS requirements for health data exchange:

- Patient access to prior authorization request and decision details through a Patient Access Fast Healthcare Interoperability Resources (FHIR) API.

- Sharing of patient claim and encounter data with providers through Provider Access FHIR API.

- Exchange of data between payers through a Payer-Payer Exchange FHIR API.

- Provider access to information required when submitting prior authorization request through FHIR Prior Authorization Requirements, Documentation, and Decision API (FHIR PARDD API).

The new CMS rule also details specific technical guidelines that must be used to comply with the various provisions. When choosing from interoperability solutions that meet all outlined technical requirements, you should carefully consider which platform makes the most sense for your specific business needs and provider network. Determining the appropriate requirements for your system selection will help ensure you make a choice that sets you up for success. Tegria has deep experience with supporting payers through customized system selection processes.

Roster the right team of experts to design, build, and maintain your interoperability solution:

- Dedicated resources with provider-payer interoperability implementation experience, specifically experience utilizing Health Level 7® (HL7®) FHIR® standard API to support electronic prior authorization.

- Business Intelligence resources with subject matter expertise in prior authorization metrics and retrieving member claims and encounter data.

- Prior authorization subject matter experts with deep knowledge in decision criteria and related turnaround times for Medicare Advantage and Medicaid provider requests. The resource should be well versed in specific decision reasons, including decision reasons sent to the requesting provider when a prior authorization request is denied. PA experts should also have experience with electronic prior authorizations and the Merit-based Incentive Payment System (MIPS).

- Member eligibility resources with subject matter expertise with interoperability with both patients and providers.

- Claims resources with subject matter expertise in encounters and claims adjudication.

Identify opportunities to leverage the additional data and interoperability capabilities.

With strategic planning and partnerships, payers can not only comply with CMS requirements but improve core competencies and member experience. Introducing new interoperability channels with provider partners and strategically integrating data into downstream systems can help improve efficiency along with provider and member experience.

For example, many interoperability platforms offer electronic Release of Information (ROI) and chart retrieval. This exchange could significantly improve prior authorization medical necessity review if the data is available to the right staff, in the right system, and at the right time. Spending more time upfront to thoroughly assess potential benefits and opportunities can help ensure that payers get the most out of an enhanced interoperability platform.

Consider payer-provider partnerships when building your strategy.

Before approaching provider onboarding conversations, it is important to deeply understand the provider’s needs around interoperability. Clearly articulating how and why providers will benefit from spending their resources on your interoperability solution will help increase success.

These new guidelines will undoubtedly shape payer priorities in the coming years. Whether payers need to prioritize coding accuracy, provider outreach and onboarding, interoperability capabilities, or all of the above, strategic planning and strong partnerships can help minimize the disruption, costs, and delays associated with organizational change.

Wherever you are on your interoperability journey, Tegria can help.

Whether you’re just getting started, ready to move to the cloud, or somewhere in between, we meet you where you are, guiding you on your journey toward achieving operational readiness, collaborative provider payer relationships, and realization of ROI.