Insight

6 Ways Revenue Cycle Leaders Can Balance Urgency With Empathy

By Margaret Martin, Managing Director, Revenue Cycle Transformation

Healthcare organizations are navigating a season of financial uncertainty. With looming Medicaid reimbursement cuts, higher rates of denied claims, and the rising cost of labor and technology, the pressure to deliver short-term financial results has rarely been greater. Yet focusing solely on immediate cost containment can erode patient trust and loyalty. Once lost, these assets are difficult to recover.

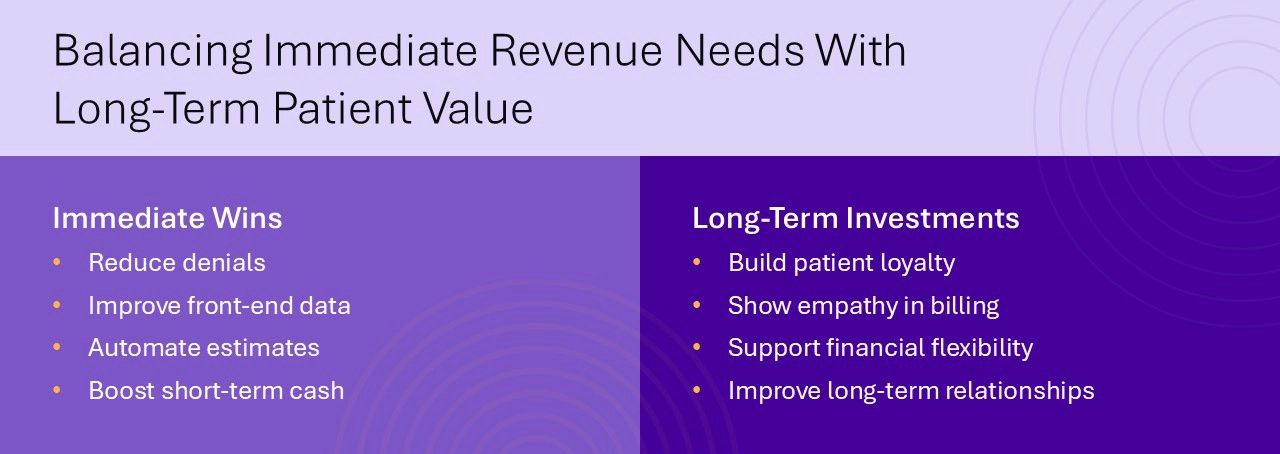

To succeed in today’s climate, healthcare leaders must strike a balance: Stabilize revenue performance in the short term while investing in the long-term value of patient relationships. That means leading with empathy, aligning revenue operations with patient expectations, and building a more resilient, patient-centered approach to revenue cycle performance.

Stabilize Financial Performance With Immediate Wins

When budget pressures mount, quick wins are essential. Fortunately, several revenue cycle strategies can yield measurable returns within 12 to 18 months without compromising patient experience.

1. Focus on Denials Management

Denied claims continue to be one of the largest sources of revenue leakage across the industry. Reducing avoidable denials not only improves cash flow, but also reduces administrative burden and staff burnout.

A large academic health system partnered with Tegria to optimize revenue cycle processes after transitioning to a new EHR. Tegria helped minimize financial risks, mitigate challenges, and improve revenue integrity to drive down denials. Over the course of the engagement, more than 1,000 denials were prevented, and auto-accepted secondary claims increased by 321%. Read the case study.

2. Improve Front-End Data Collection

Clean claims begin with clean data. Registration errors, eligibility mismatches, and missing demographics often originate at the front end and ripple downstream. Correcting these issues in real time can eliminate the need for costly rework later.

3. Optimize Patient Estimates and Payment Flexibility

Today’s patients expect clarity and control when it comes to healthcare costs. Organizations that provide upfront estimates and payment plan options are more likely to collect patient responsibility and preserve goodwill.

University of Colorado Health partnered with Tegria to transform their patient estimate process for greater accuracy and transparency. Their solution increased estimates by 6,000% and improved estimate accuracy by 30% to reduce billing surprises for patients. Read the case study.

Invest in Long-Term Patient Relationships

While financial stability is urgent, the path to sustainable growth runs through long-term relationships. Patients who trust their providers are more likely to return, refer others, and engage in their care. Revenue cycle teams play a vital role in shaping that trust.

4. Extend the Patient Relationship Horizon

Viewing patients through a transactional lens can be shortsighted. Instead, organizations should consider patient lifetime value: the total revenue, impact, and loyalty a patient brings over time.

Accurate billing, proactive communication, and streamlined financial touchpoints all contribute to a positive experience. Investments that build patient trust today can yield years of future engagement.

5. Show Empathy in Billing Practices

Medical debt is a leading source of financial hardship in the U.S., and patients often delay or avoid care due to cost concerns. Revenue cycle teams have the power to change that narrative by leading with empathy.

Simple actions like offering income-based discounts, flexible payment terms, and accessible billing statements can transform the patient financial experience, resulting in loyal patients who return year after year.

6. Recognize the Impact of Financial Stress on Trust

Financial stress impacts patients beyond their wallets, by eroding trust in the entire healthcare system. When patients are surprised by a bill or feel dismissed when they ask for help, they’re less likely to seek care in the future.

To prevent this, healthcare organizations must integrate access, care, and financial functions into one coordinated experience. When patient access staff, clinicians, and billing teams work together, patients benefit from clear expectations and compassionate support.

Building an Integrated Approach

Silos between financial, operational, and clinical departments often stand in the way of progress. To deliver a better financial experience for patients, organizations must unite these functions around shared goals.

That includes:

- Sharing real-time data across access, billing, and clinical systems

- Training staff to speak the same language of patient empathy

- Leveraging technology to automate routine tasks and flag issues early

- Embedding empathy and equity into every financial touchpoint

Tegria partners with healthcare organizations to design and implement these integrated approaches, resulting in stronger revenue performance and improved patient loyalty.

Conclusion: Sustainable Growth Requires a Balanced Approach

In times of financial stress, it’s tempting to focus on short-term gains alone. But healthcare organizations that also prioritize long-term patient relationships will emerge stronger.

Immediate improvements in denials management, front-end workflows, and patient estimates can create fast, measurable impact. At the same time, embedding empathy into billing practices builds trust that pays dividends far beyond the current fiscal year.

Tegria helps organizations align revenue cycle performance with patient-centered care—so you don’t have to choose between financial health and human connection.