Case Study

Optimizing After Go-Live Increases Efficiency, Reduces Denials

- Customer: Large academic health system

- Challenge: Optimize a new electronic health record (EHR) to increase efficiency by updating and automating processes wherever possible

Results

- 321% increase in auto-accepted secondary claims

- 329% increase in coverages found in Q3 of 2022

- $1.06 million captured through correct records routing

- More than 1,000 denials prevented

Background and Challenge

Tegria was engaged by a large healthcare system in the southwestern U.S. that was preparing to implement a new EHR. Tegria helped them minimize financial risks, mitigate challenges, stabilize during and after go-live, and return to organizational baselines as quickly as possible. After go-live, the organization was ready to begin optimizing the new system.

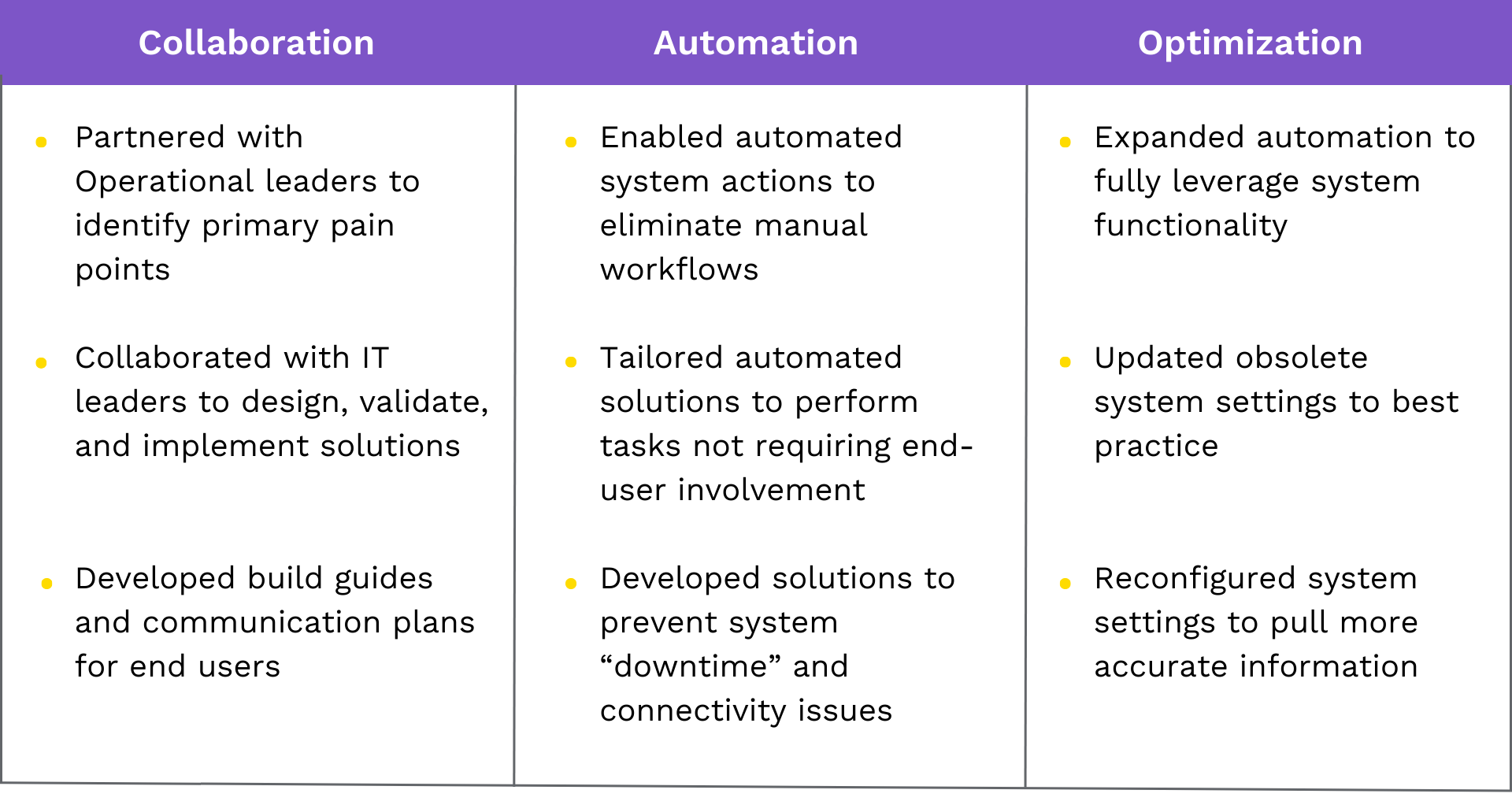

Tegria’s experts returned in 2022 to assist with optimization and automating processes wherever possible to allow staff to focus on high-priority issues. The second engagement was divided into three distinct sprints that focused on the following:

- Duplicate claims denials

- Eligibility rejections

- Credit profile and undistributed credits

- Global period and bundling

Solution

Many manual workflows were eliminated by enabling automated system actions and tailoring the automated solutions to perform tasks not requiring end-user involvement. Tegria also developed solutions to prevent system downtime and connectivity issues, updated obsolete system settings to best practice, and reconfigured system settings to pull more accurate information.

Results

During the project, Tegria experts created a detailed list of 50-plus findings and recommendations to be addressed in current or future optimization sprints. Key results of this effort included:

- 7.6% reduction in monthly average of duplicate claim denials

- 321% increase in secondary claims properly submitted and auto-accepted

- 329% increase in coverages found in Q3 of 2022

- 5% productivity gain with automated coverage scanning

- 4% increase in self-pay credits automatically resolved – Gold medal status

- $1.06 million captured through correct records routing

- 3.5% reduction in EKG-related denials

- More than 1,000 denials prevented